This course is specially designed for the professional credit manager who needs to take time out to sharpen up existing skills and to share and compare knowledge with fellow professionals.

The workshop is geared towards group activity whilst also giving plenty of time for individual personalities to grow in confidence. By sharing and comparing their skills, credit managers will leave the course renewed and enthusiastic about their way forward for their respective organization.

Learning Objectives:

- At the end of this session, participants will be able to:

- Explain the developing role of the credit manager;

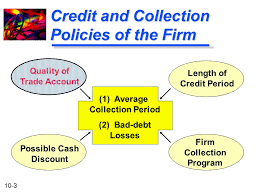

- Create credit policy and procedures;

- Improve cash recovery and management;

- Conduct economic forecasts;

- Implement the credit health-check approach;

- Prepare and interpret financial statements.

Course Outline

- Developing and implementing a debt management process

- Focusing on the loopholes within your organization

- Introducing new procedures to help boost your cash collection

- Finding your organization’s critical success factors

- Converting your monthly reporting to a decision-based tool

- Credit risk based customer segmentation

- Flexible determination of collection activities based on Business Rules Framework (BRF)

- Collections work list management

- Processing collections work items (outbound/inbound)

- Promise-to-Pay Evaluation of collection success

Course Timeline:

Test

This session complet...

Test

The essence of this ...

This is the first lesson in your three days of intensive training on Credit Management and Collection of Receivables. This lesson introduces the fundamental concept of credit management. It covers

1. Introduction

2. Characteristics of credit

3. Types of credit

4. Credit policy and organisation

5. Formulating your credit policy

6. Credit referencing

7. Financial statements

8. Credit reports

9. Purpose and scope of the agency report

10. External factors affecting a credit decision

11. Internal factors affecting credit decision

12. More generous credit is needed when

13. Restrict credit when

14. Criteria for a credit policy

15. Role of the credit policy documents

16. Contents of the credit policy document

This lesson covers chapters such as:

17. Credit control

18. The sales contribution

19. Collection efficiency measures

20. Determining the credit period

21. Working capital

22. Financial ratios

23. The credit manager

24. Essentials for successful credit management

25. Debt recovery policies

26. Causes of credit failures

27. Categorization of debtors

28. Best recovery approaches

29. Invoices and statement

30. Collection letters

31. Telephone conversations

32. Personal calls

This Lesson exposes you to various roles confronting you as a Credit Manager. It includes instructions as:

33. Collection agencies

34. Debtors tricks and how to tackle them

35. Patronizing debtors

36. Ambush an evasive debtor

37. Force of persistence

38. How to handle settlement proposal

39. Traditional method of debt recovery

40. Legal rights of the borrower and the lender

41. Process and implications of bankruptcy & liquidation

42. bankruptcy processes:

43. loan workouts

44. pre-negotiation preparation

45. the presence of lender liability

46. workout negotiations

47. fighting the lender in court

48. case study

Test

The objective of thi...